Why It Matters

Aluminum is everywhere—from cans, cars and buildings to fighter jets, tanks, armor and satellites. The United States relies on a combination of domestic and imported primary aluminum as well as scrap aluminum to meet demand. To keep making these products at home, the U.S. industry needs two things: reliable metal supply and abundant, affordable energy.

Today about two-thirds of the primary aluminum the United States uses each year is imported from Canada. At the same time, too much high-quality aluminum scrap leaves the country—weakening our supply chains and the defense industrial base.

By increasing the domestic aluminum scrap supply, we would free up more primary aluminum, which is often used in national security applications, to support the American warfighter.

At a glance

- ~85% of current U.S. aluminum production relies on recycled scrap as a major input.

- Recycling aluminum uses ~5% of the energy needed to make new (primary) metal.

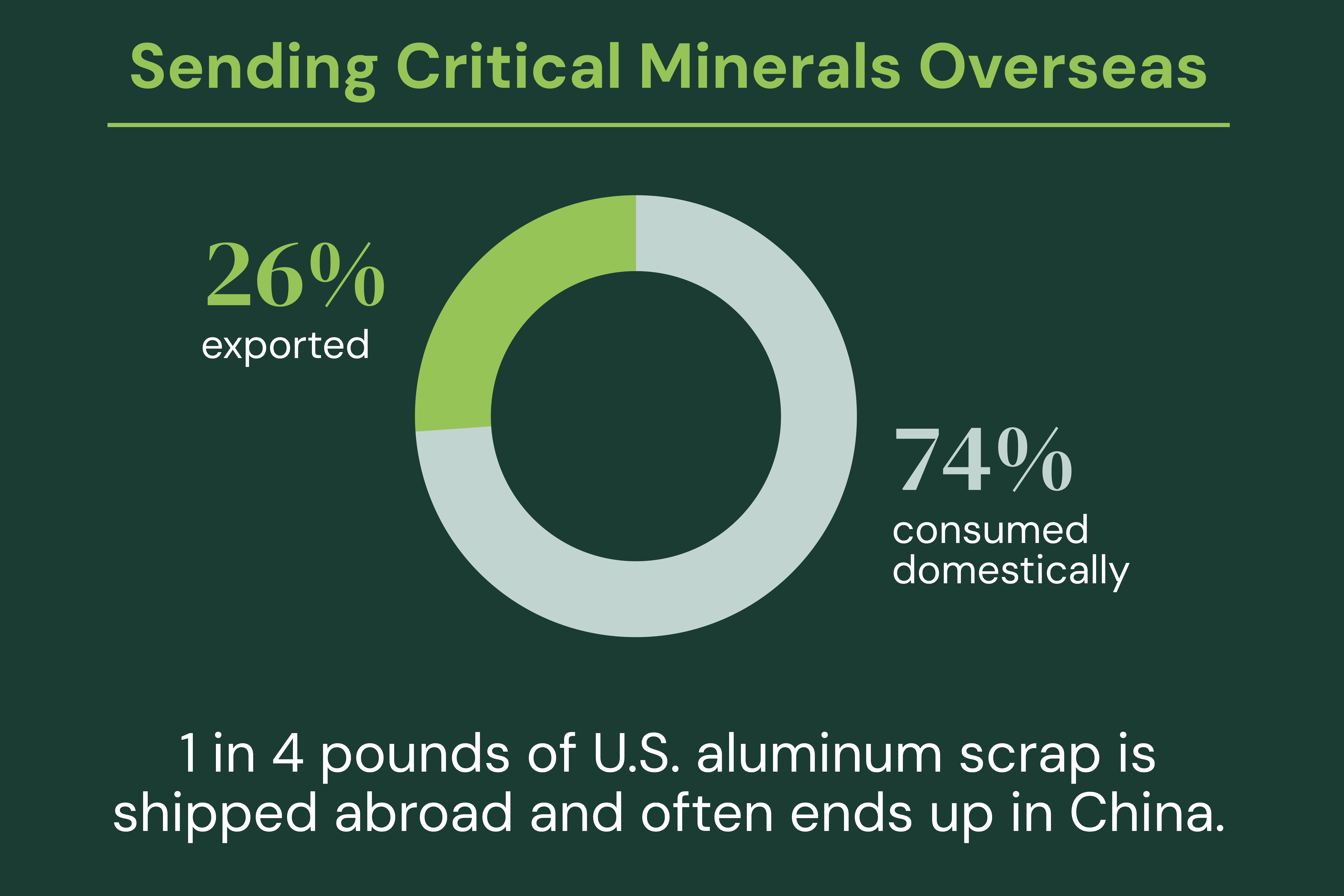

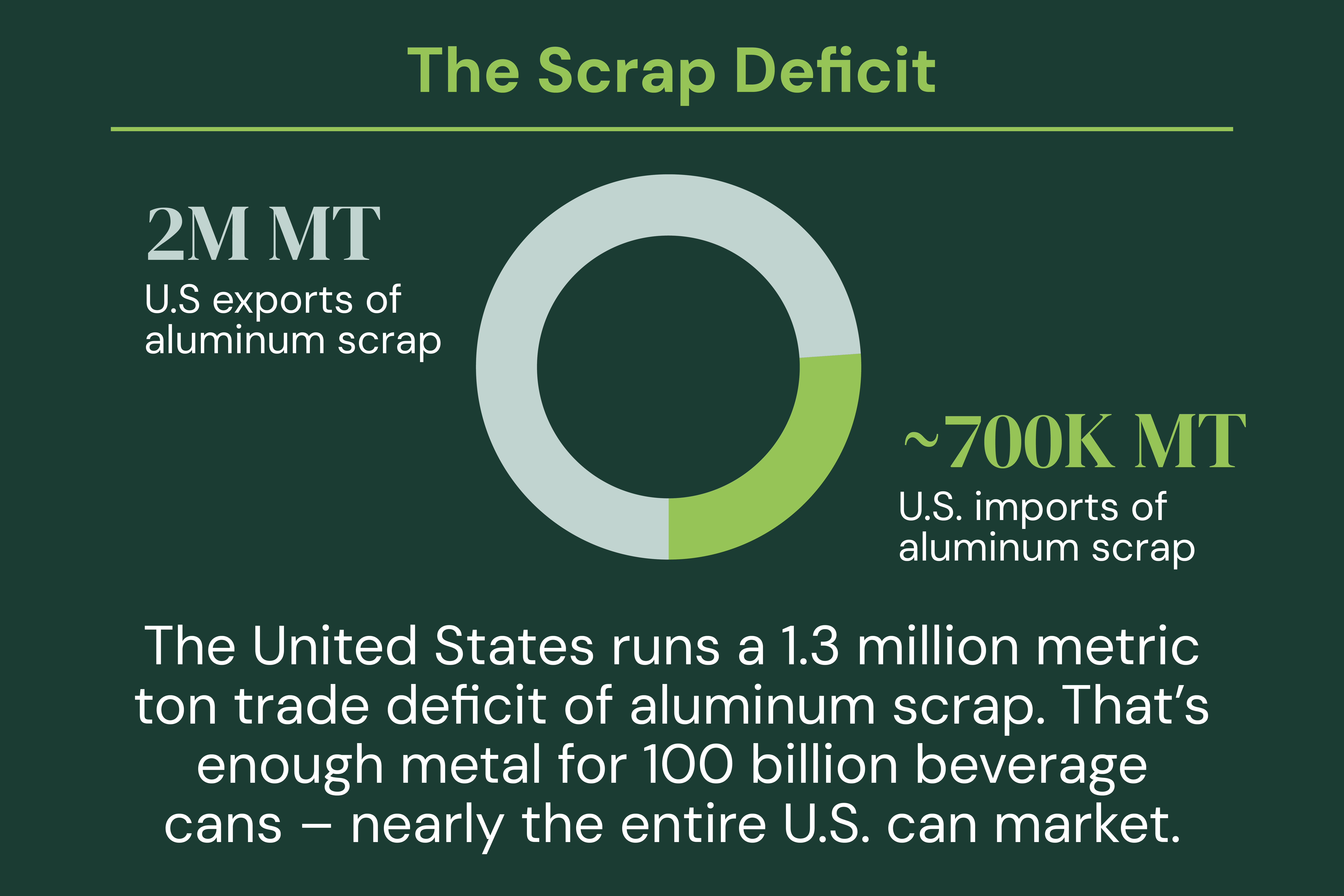

- The U.S. exports ~2 million metric tons (MT) of aluminum scrap each year—more than a quarter of total scrap supply.

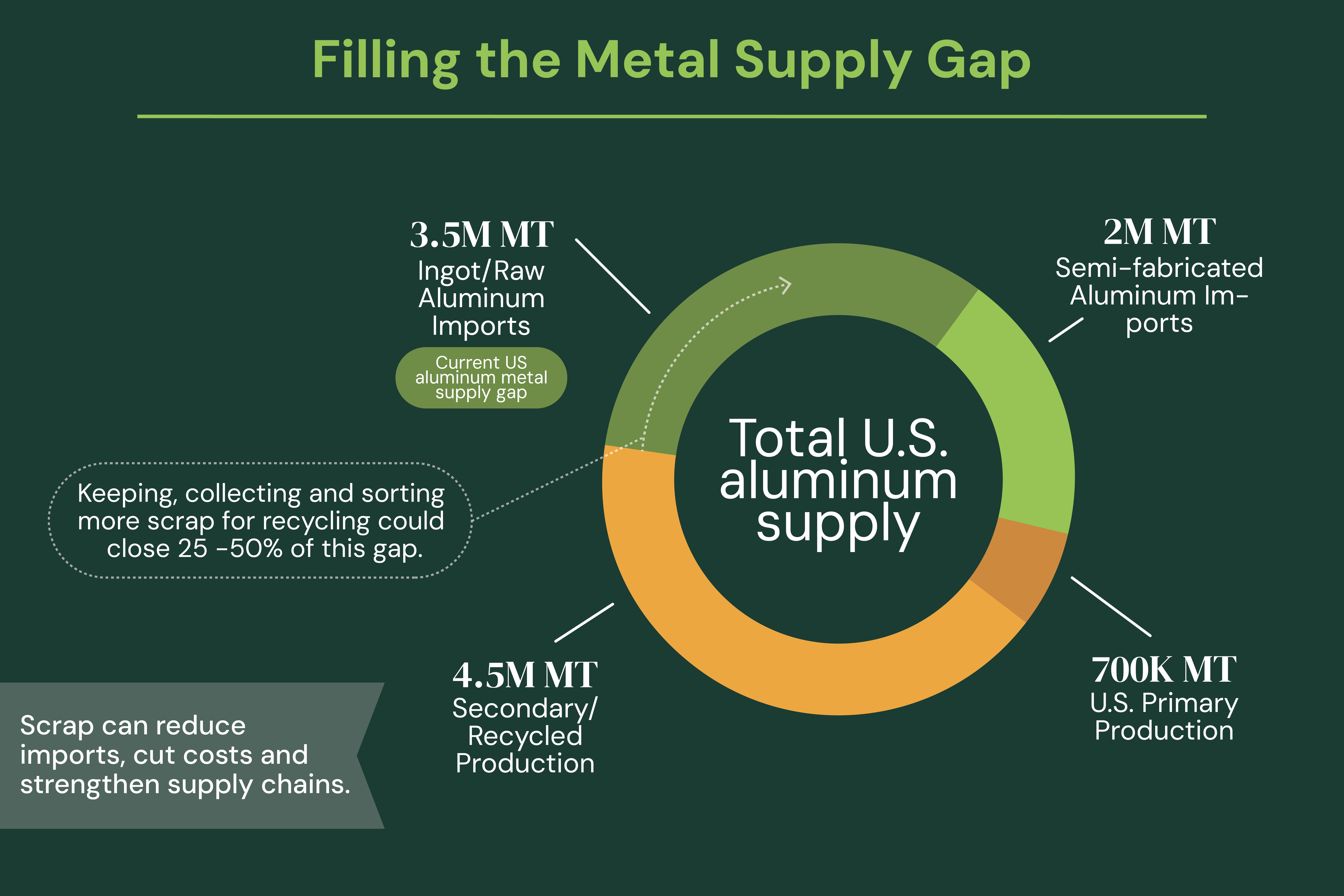

- This worsens a 3.5 million MT aluminum supply gap, driving aluminum imports.

- Much of our scrap flows to non-market economies, especially China, where it’s subsidized, processed and shipped back as finished goods that undercut U.S. manufacturers.

What's Changing

China is rapidly scaling subsidized aluminum recycling—and has more than doubled its scrap imports since 2020. Its goal: over 15 million MT of recycled aluminum by 2027. Allowing this cycle to continue risks repeating the decline of U.S. primary smelters—down from 24 to just 4 since 2000.

Bottom line: U.S. scrap exports are fueling a strategic competitor while exposing American manufacturers to unfair competition.

A Practical Fix: Targeted Scrap Export Controls

Focused, surgical export controls on specific, mill-ready grades can keep high-value material at home—closing a major share of the U.S. supply gap with scrap we already generate.

- High-impact step: Ban exports of Used Beverage Containers (UBCs).

- Improve trade codes for tracking metal flows and invest in scrap sorting infrastructure.

- Consider restrictions on other mill-ready grades to stabilize supply for world-class U.S. rolling and recycling investments.

Why this works

- Secures feedstock for more than $11 billion in domestic investments since 2016, including generational rolling mill expansions.

- Reduces import dependence so scarce primary metal can be prioritized for defense needs.

- Aligns the U.S. with other major aluminum producers (China, India, Russia, Saudi Arabia) that already restrict high-value scrap to protect domestic industry.

- Supports an integrated North American market while curbing leakage to non-market economies.

Policy Actions the U.S. Can Take Now

UBCs are defined with a unique tariff code; are highly sought after by U.S. re-melters; and are needed today. Immediate action on UBCs will support U.S. aluminum industry investment in the near term and further efforts to onshore manufacturing. The UBC ban should not apply within North America where the free flow of aluminum scrap is vital for industries in USMCA countries. Imported UBCs from Canada and Mexico are a vital feedstock for the U.S. can sheet market especially and should be traded within North America with zero tariff or other restrictions.

Trade codes today lump many types of scrap together, making it difficult to enforce rules. The U.S. Census Bureau, Customs & Border Protection and the U.S. International Trade Commission should work with the aluminum industry to fine-tune Schedule B and USHTS codes so that high-value material like mill-ready scrap can be identified. Better codes help CBP track and control exports more closely, ensuring the United States does not export material it can easily use and does export metal it cannot.

As tariff codes and export tracking is further refined, policymakers should also consider potential export restrictions on other forms of mill-ready aluminum scrap. (The industry is not calling for a full scrap export ban at this time as domestic technology matures to better process Zorba, Twitch and other lower grade scrap.) There are multiple mechanisms the administration can deploy to enact scrap export restrictions, from full bans to a business license approach. In addition to potential legislative fixes, the president also has authority under Section 301, the Defense Production Act and the Export Control Reform Act to address this issue.

Large amounts of scrap aluminum, particularly lower-grade Zorba, is currently difficult to process and recycle economically and at scale in the United States. The domestic industry is currently investing in new technologies to address this problem. Government investment and public-private partnerships could speed up this process and enable the industry to keep more scrap at home for domestic use. Current bipartisan legislation in Congress including the CIRCLE Act would act as a downpayment on improving American recycling infrastructure.

Learn More