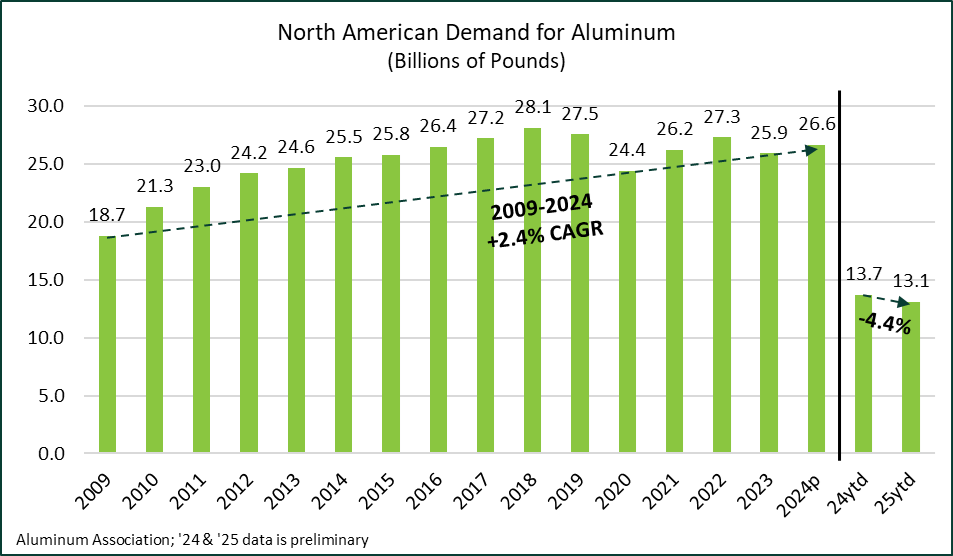

North American Aluminum Demand Down 4.4% Through First Half 2025

Exports, Domestic Shipments Decline Across Major Markets

The Aluminum Association released preliminary estimates as part of its monthly Aluminum Situation statistical report that show a 4.4% year-over-year decline in aluminum demand for North America (U.S. and Canada) through H1 of 2025. While a significant decline in exports was a main contributor to the overall contraction, demand fell in all market segments, with the exception of foil.

“We are carefully monitoring the market as more data becomes available on how the current tariff landscape is impacting the industry,” said Charles Johnson, president & CEO of the Aluminum Association. “As we look ahead, it’s critical to ensure trade policies support — not strain — the U.S. aluminum industry. With 98% of American aluminum jobs in the mid-and downstream sectors, we need a more targeted trade approach that protects against unfair practices while keeping America’s aluminum industry strong and competitive.”

Among key takeaways from the report:

- Aluminum demand in the United States and Canada (shipments by domestic producers plus imports) totaled an estimated 13.1 billion pounds through June 2025, declining 4.4% from the like-2024 total of 13.7 billion pounds

- The association's Domestic Producers Shipments & Inventories report indicates that producer shipments from U.S. and Canadian facilities decreased 4.5% year-over-year through June. This number excludes imports to more clearly reflect industry aluminum and aluminum product shipments by North American firms.

- The decline in domestic producer shipments was driven primarily by a decline in aluminum mill products, which contracted 1.6% while shipments of aluminum ingot for castings, exports and destructive uses declined 11% year-over-year.

- Aluminum scrap inventory increased 14.7% so far in 2025, driven by tariff policy that is incentivizing the use of scrap.

- Imports of aluminum and aluminum products into North America increased 15.8% year-over-year in the first half, entirely driven by imports of unwrought aluminum.

The U.S. aluminum industry invested more than $10 billion in U.S. operations over the past 10 years, powered by strong demand, strategic trade enforcement and a stable policy environment. The Trump administration has consistently acknowledged aluminum’s critical role in both economic and national security. However, the administration’s universal 50% aluminum tariff risks undoing hard-earned gains and jeopardizes a decade of progress. The Aluminum Association is calling on policymakers to pursue a more focused, targeted approach to trade—one that strengthens the domestic industry without disrupting the 98% of industry jobs that rely on access to affordable aluminum inputs.

The Aluminum Situation report is one of more than two-dozen ongoing industry statistical reports developed exclusively by the Aluminum Association through surveys of aluminum producers, fabricators and recyclers. Subscribers to the Aluminum Association statistical reports have access to an online portal with data users can manipulate directly to produce interactive, presentation-ready charts and graphs.

To learn more about the Aluminum Association’s statistical offerings or to subscribe, visit www.aluminum.org/statistics.