Powering Up American Aluminum: A Roadmap for Next Generation Supply Chain Resilience

The aluminum industry needs access to a reliable metal supply and abundant, affordable energy to continue to grow and expand in the United States. A new white paper, developed by the Aluminum Association and Wittsend Commodity Advisors, lays out potential pathways to move the U.S. aluminum industry toward greater domestic self-sufficiency.

Essential American Industry

Aluminum is a critical material for our nation’s economic and national security. It's in everything – from cars and cans to fighter jets, tanks and the electric grid. The aluminum industry supports nearly 700,000 jobs and generates more than $228 billion in economic impact. In 2024, key sectors across the aluminum industry (recycling & sheet/plate) saw record jobs since the Aluminum Association began tracking in 2013. At the same time, the industry has invested more than $10 billion in U.S. operations over the last decade, including two new aluminum rolling mills for the first time since 1980.

The U.S. aluminum industry looks very different today than it did 25 years ago, but it continues to pursue generational investment.

Since 2000:

- Operating U.S. primary aluminum smelters declined from 24 to 4 today due to lack of low-cost domestic electricity and unfair trade practices in China

- North America went from producing the most primary aluminum on earth to 4th place today with output dwarfed by China

- Demand for aluminum grew consistently as the U.S. industry evolved and shifted its business mid-and-downstream

- Domestic aluminum recycling grew by ~1/3 and now accounts for ~85% of U.S.-made aluminum

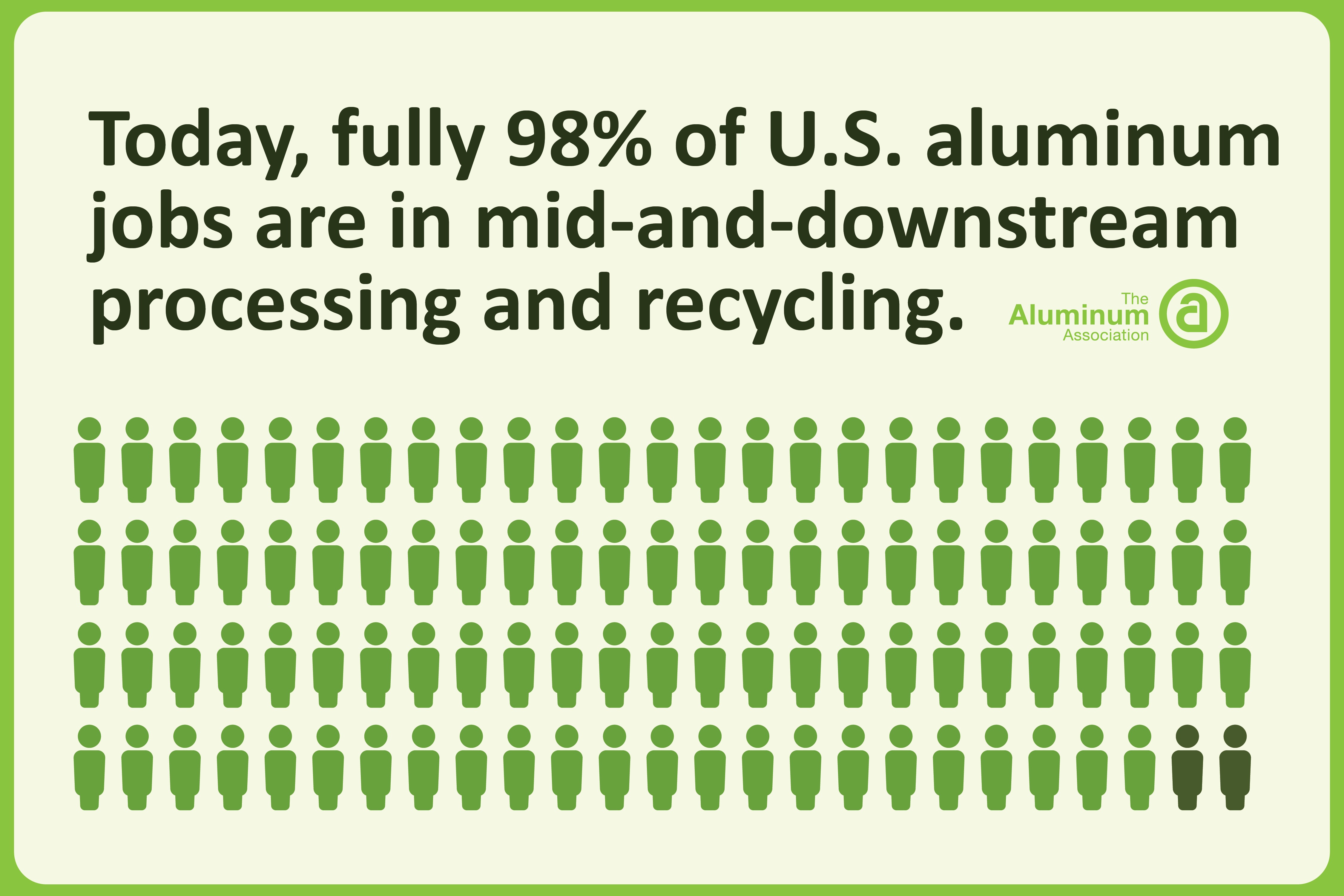

- Nearly 98% of all U.S. aluminum jobs today are in mid-and-downstream processing and recycling.

Despite a ~70% decline in primary aluminum jobs since 2013, overall industry jobs are effectively flat as employment shifted downstream and certain industry segments have seen record job growth. Strong trade enforcement including Section 232, Section 301 and antidumping/countervailing duty tariff interventions during the first Trump administration supported this growth.

Pathways to Self-Sufficiency

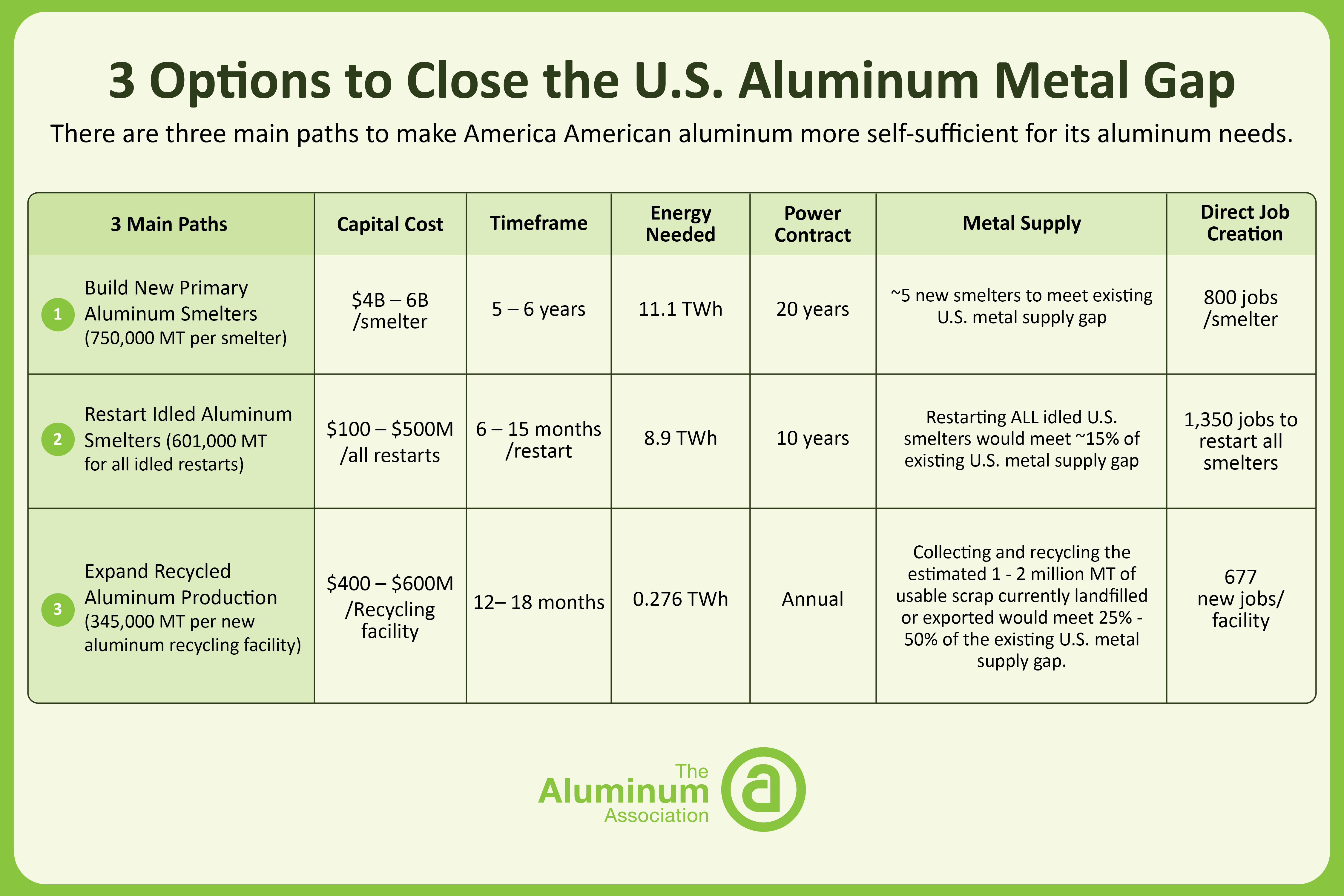

Achieving U.S. aluminum self-sufficiency will require time, money and commitment from both the public and private sector to build new smelters and recycle more aluminum. Powering Up American Aluminum: A Roadmap for Next Generation Supply Chain Resilience, developed by the Aluminum Association and Wittsend Commodity Advisors, lays out three potential pathways to move the U.S. aluminum industry toward greater domestic self-sufficiency.

The white paper focuses on:

New: There are undoubtedly opportunities to build new aluminum smelting capacity in the United States, including two projects currently under discussion. Building such facilities will take time (5 – 6 years), significant capital investment ($4 - $6 billion/facility) and long-term, competitive power contracts and the equivalent annual electricity usage of the city of Boston or Nashville. To fully meet current metal needs, the United States would need to build around five 750,000 metric ton smelters. The largest fully operational smelter in the United States right now is 220,000 metric tons.

Restart: Slightly less than half of installed U.S. primary aluminum capacity is currently in operation. Bringing this metal back online from 4 existing smelters would require long-term, competitively priced power contracts and still significant capital investment. Even then, restarting all idled smelters would only meet around 15% of the current 4 million metric ton metal supply gap.

While domestic primary production has declined over recent decades, recycled (or secondary) aluminum production has grown, hitting record levels in 2024. Recycling aluminum is about 95% less energy intensive than primary production and relies largely on scrap aluminum as an input material. Building aluminum recycling facilities is also far less capital intensive. New sorting technologies could unlock even more available scrap aluminum. Collecting and recycling the estimated 1 - 2 million MT of usable scrap currently landfilled or exported would meet 25% - 50% of the existing U.S. metal supply gap.

As the industry works to produce more domestic aluminum, access to affordable, reliable Canadian primary aluminum is a vital bridge for metal supply and a good deal for America. The aluminum the United States imports from Canada is equivalent to more than 4 Hoover Dams worth of energy each year – often at a significant discount from direct electricity imports. Aluminum smelters in Canada typically pay $25 - $40 per MWh of electricity vs. $60 - $80 per MWh in the United States. Further, every one aluminum smelter job in Canada supports about 13 U.S. aluminum jobs further downstream.

Enormous electricity requirements for primary aluminum production poses a unique challenge for industry self-sufficiency. A single new aluminum smelter uses ~11 TWh – a similar amount of electricity every year as a major U.S. city like Boston or Nashville. Furthermore, to be economically competitive, a smelter requires a 10 – 20 year contract with electricity costs ~$40/MWh. Technology companies are currently committing upward of $115/MWh for power at AI data centers. The Department of Energy estimates that an additional 100 GW of new peak hour energy supply will be needed by 2030 on current trendlines.

Policies to Support Great American Self-Reliance

Energy/Manufacturing

- Expand access to abundant, affordable energy for manufacturers.

- Pursue permitting reform to help manufacturers build.

- Support natural gas production, pipeline expansion and explore new energy sources.

Trade

- Ensure tariff-free access to Canadian aluminum imports to support U.S. metal demand.

- Expand the list of aluminum derivative products covered under Section 232 tariffs.

- Enforce existing USMCA protections and strengthen monitoring and enforcement to protect North American manufacturing from unfairly traded metal and circumvention.

Recycling

- Increase the availability of scrap aluminum to manufacturers:

- Invest in new recycling infrastructure including technology to sort recyclable metal so that it can be used as input material.

- Encourage recycling through consumer-facing collection infrastructure and state policies that create financial incentives to recycle.

- Support policies that keep scrap aluminum at home for domestic consumption and production.

Learn More