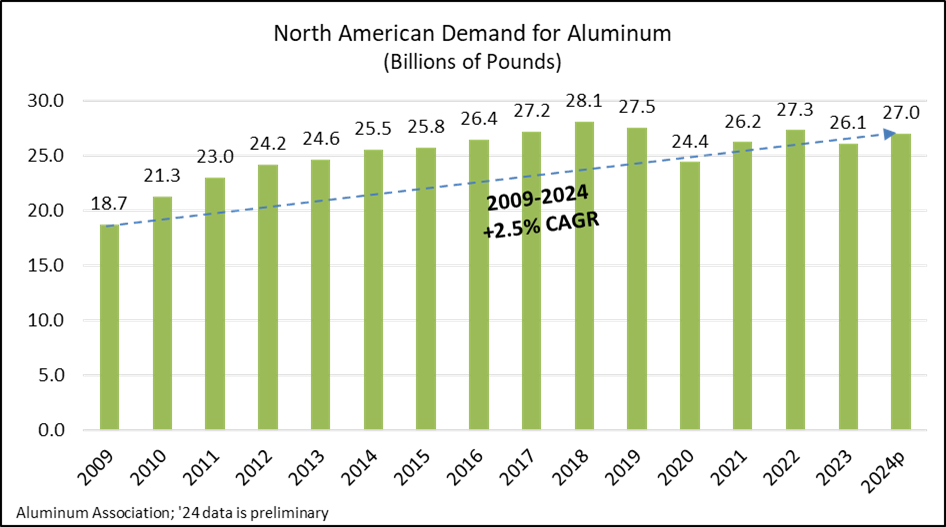

North American Aluminum Demand Rebounds 3.4% in 2024

Preliminary Estimates Reveal 2.5% compound annual growth rate (CAGR) since 2009

As part of its monthly Aluminum Situation statistical report, the Aluminum Association released preliminary estimates showing 3.4% growth in year-over-year demand for the aluminum industry in North America (U.S. and Canada) in 2024. At just shy of 27 million pounds, 2025 aluminum demand in the United States and Canada exceeds the 10-year average.

“North American aluminum demand approached record levels in 2024,” said Charles Johnson, president & CEO of the Aluminum Association. “Despite some economic and market uncertainty ahead, the aluminum industry has shown time and time again that it is built to last. Our material is the essential element for the future of transportation, packaging, infrastructure even defense equipment.”

Among key takeaways from the report:

- Aluminum demand in the United States and Canada (shipments by domestic producers plus imports) totaled an estimated 26,969 million pounds in 2024, compared to the 2023 total of 26,087 million pounds.

- The association's Domestic Producers Shipments & Inventories report indicates that producer shipments from U.S. and Canadian facilities reached an estimated 23,729 million pounds in 2024, an increase of 3.2 percent over the 2023 total of 22,987 million pounds. This number excludes imports to more clearly reflect industry aluminum and aluminum product shipments by North American firms.

- Since 2009, the domestic aluminum industry has enjoyed a 2.5% compound annual growth rate (CAGR).

- In total, semi-fabricated – or “mill” – product demand was up 3.4% year-over-year.

- Exports of aluminum ingot and mill products from the U.S. and Canada (excluding cross border trade) increased 12.8% in 2024.

- At 106.29, the Association’s Index of Net New Orders of Aluminum Mill Products (baseline index of 100) increased 1.2% over 2023 on average.

- Imported aluminum and aluminum products into the North America (US and Canada) declined by 4.2% through year end 2024.

Over the past decade, Aluminum Association member companies have announced more than $10 billion in investments for domestic manufacturing operations. More than half of that investment has been announced since 2021 – thanks to demand for reusable packaging, safe and efficient vehicles, durable infrastructure, a reliable electric grid and more.

The Aluminum Situation report is one of more than two-dozen ongoing industry statistical reports developed exclusively by the Aluminum Association through surveys of aluminum producers, fabricators and recyclers. Subscribers to the Aluminum Association statistical reports have access to an online portal with data users can manipulate directly to produce interactive, presentation-ready charts and graphs.

To learn more about the Aluminum Association’s statistical offerings or to subscribe, visit www.aluminum.org/statistics.